In today’s fast-paced world, credit cards have become one of the most essential parts of our financial lives. These convenient payment tools offer plenty of benefits, and one such advantage is earning airline miles. Airline miles are reward points or loyalty points, which can be accumulated through credit card spending, and you can later redeem them for your air travel or other travel-related expenses. Under this guide, you can learn everything about the best credit card for airline miles with no annual fee.

Credit card is one of the most convenient ways to pay bills while shopping, or traveling. It is seen that 84% of adults in America own a credit card in the year 2021. Many of us wish to use the points of airline miles. You can redeem and use them in multiple ways. Nonetheless, paying annual charges is something we wish to avoid.

However, do you wish to pay zero annual charges? Stay tuned to explore more about the best credit cards for airlines with zero annual charges.

What is a credit card?

A credit card is ideally a payment card that a financial institution issues, and it allows you to borrow funds and make purchases. Unlike a debit card, where funds are withdrawn directly from the user’s bank account, the credit card will create a line of credit that should be repaid with interest. If you cannot pay it in full, what do you need to do? Pay it with a specific billing cycle. Credit card is way different from travel credit cards, with no annual fee.

It can be termed as a physical card that is used to make payments, purchases, pay bills, or depending on the card, withdraw cash too. When an individual opens a credit account the bank gives that respective individual a set of credit limits which they’ve to pay later or say by the due date that the issuer sets.

How does a credit card work?

With the help of a credit card, you can pay bills either online or at offline stores. When you make a payment through the credit card all your credit card details are sent to the merchant’s bank.

Then the respective merchants’ bank gets the authorization from the credit card network to process the transaction, your card issuer then has to verify your information and either approve or decline the transaction.

If by chance a payment that you were making gets approved the specific amount gets deducted from your credit limit. Later, in the month your credit card issuer will send you the statement of the various such payments you made the entire month. And if you pay your bill in full in the grace period no interest will be charged.

Credit card fees?

Credit cards not only have an interest rate but also multiple fees additionally. Fees can be in the form of balance transfer fees, the fee charged for late payment to the issuer, and many more.

There are other fees included such as:-

1) Over-limit fees:- which is charged if you go over your card’s limit.

2) Late fees:- which is charged if you don’t make the minimum payment by the due date. If you are way later than the due date the issuer may also revoke any Introductory rate.

Credit card impacts your credit score directly.

On which basis does the credit score calculate?

1) Payment history

2) Credit usage

3) Credit age

4) Credit mix

5) Inquirabouts of new credit

What do you understand by “ airlines Miles”?

Airlines Miles are nothing but the airline’s currency that you can use by redeeming them for flights, hotel stays and other rewards as well.

Many airlines use the term “points” instead of currency but the whole concept is the same. Another word for “Airline miles” is “Frequent flyer miles”

The airline miles are prominently known as frequent flyer miles or travel points, and they are rewards that you own as Sky Miles credit cards with no annual fee users through your specific spending activities.

These miles can be redeemed for your flight upgrade or hotel stays, and other travel-related expenses. It provides you with excellent benefits and cost savings so you can be stress-free.

Why should you get the best credit card for airline miles with no annual fee?

You need to acquire a credit card specially designed to earn airline miles as it is a significant financial move for frequent Flyers and if you aspire to explore the world. By using such credit cards for everyday purchases, you can accumulate miles allowing you to travel affordably, even for free. Furthermore, several Best Miles credit cards with no annual fee offer you enticing signup bonuses and perks, making them appealing for you if you’re looking forward to making the most of your travel benefits.

How do you earn Airline Miles?

In earlier times, the best way to earn was to fly as much as possible in business/first class if you could afford it. But as time changed the airlines started business with the banks, businesses & other travel providers which created a major hike in their business as they sold their miles and hence it results to be beneficial for the consumers to earn miles through those partnerships.

Things you must know before dipping your toe into earning “Airline miles” through a credit card!!!

1) First and foremost, you need to know that you have to by hook or crook pay off your credit card bill in full every month, and in case you fail, any interest charges you pay will eventually offset the value of the miles you are earning.

2) Personal credit is one of the most important assets. To get approved for credit cards, the credit score will be able to get a lease, a mortgage, or any type of loan. Even the rate you will get for your mortgage or loan also depends upon your credit score.

3) It is very essential to make sure you understand thoroughly how opening & closing credit cards will affect personal credit. As you don’t want to know to risk your eligibility for getting a house or a new car because you earned a few too many credit card bonuses.

How to choose the best credit card for you?

When it comes to choosing the best credit card for airline miles with no annual fee, then, you need to consider some factors.

Consider your spending habits.

You need to understand your typical expenses and identify the categories where you spend the most. You have to look for Credit cards with travel insurance and no annual fee that rewards all those areas.

Choose a card that offers rewards for your favorite airlines

If you have a preferred airline for your travels, then you need to consider a credit card that allows you to earn miles directly with that airline.

Read all the terms and conditions carefully

you have to be very careful, and you need to read the terms and conditions, like the signup bonus requirements and redemption options while choosing the Best travel credit card with no annual fee and no foreign transaction fee.

These are all the factors that you need to consider while choosing the best credit card for airline miles with no annual fee. By strategically selecting the right card based on your preferences and needs, you can unlock a world of travel rewards and cost-saving benefits.

BEST TRAVEL CREDIT CARD WITH “NO ANNUAL FEE”

Here are some of the Best travel credit cards with no annual fee:

1) DISCOVER IT MILES

2) HILTON HONORS AMERICAN EXPRESS CARD

3) BANK OF AMERICA TRAVEL REWARDS

4) UNITED GATEWAY CARD

5) CHASE FREEDOM FLEX

6) JETBLUE CARD

7) MARRIOTT BONVOY BOLD CREDIT CARD

8) AMERICAN AIRLINES Advantage MILES

9) CAPITAL ONE VENTURE ONE REWARD CREDIT

10)WELL FARGO AUTOGRAPH CARD

11)DELTA SKYMILES BLUE AMERICAN EXPRESS CARD

ALTAS AMERICA & PATRIOT AMERICA PLUS provide ideal travel insurance for parents visiting the USA. Both cards provide superb customer service and even better coverage.

BEST TRAVEL CREDIT CARD WITH NO ANNUAL FEE COMPARISON

| Credit Card Name | Earning Rate | Bonus Offers | Redemption Options | Annual Fee | Foreign Transaction Fees |

|---|---|---|---|---|---|

| Bank of America | Unlimited 1.5 points per $1 spent | N/A | Flights, hotels, vacation packages, and more | No annual fee | None |

| Discover it miles | Unlimited 1.5 points per $1 spent | Matches all miles earned in 1st year | Statement credit for travel purchases | No annual fee | None |

| Capital One Venture One | 1.25 miles per $1.00 spent | 10,000 bonus miles after $500 spending | Transfer to partner airlines or erase travel expenses | No annual fee | None |

| Delta SkyMiles Blue Express American | 2 miles per $1 spent on Delta purchases | 1 mile per $1.00 spent on other purchases | 20% statement credit for eligible in-flight purchases | No annual fee | None |

| United Gateway Card | 2 miles per $1.00 spent on United purchases | 1 mile per dollar spent on all other purchases | 25% discount on inflight purchases | No annual fee | None |

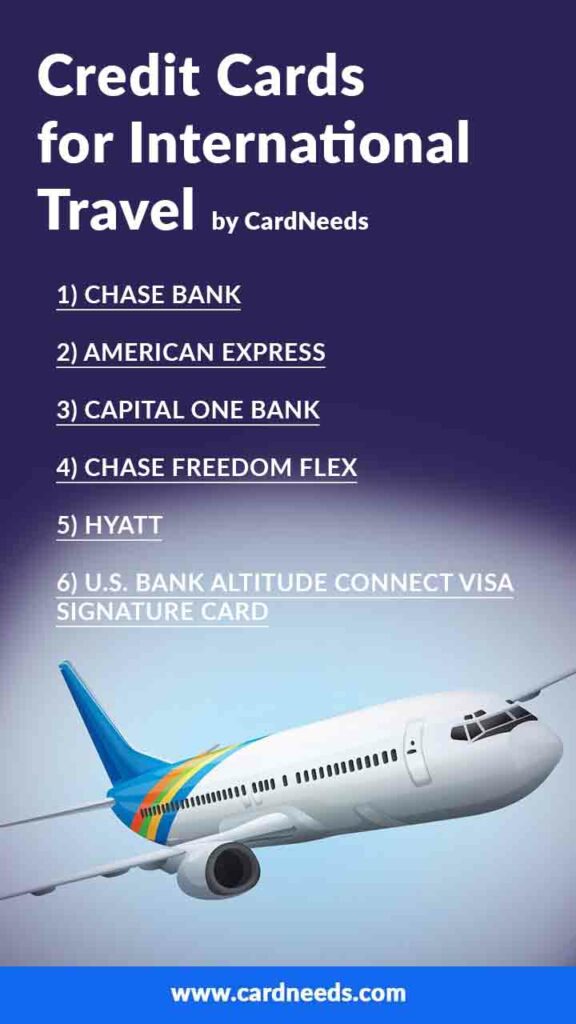

CREDIT CARDS FOR INTERNATIONAL TRAVEL

1) CHASE BANK

2) AMERICAN EXPRESS

3) CAPITAL ONE BANK

4) CHASE FREEDOM FLEX

5) HYATT

6) U.S. BANK ALTITUDE CONNECT VISA SIGNATURE CARD

BEST TRAVEL CREDIT CARD WITH THE BEST REWARDS

| Card Name | Annual Fees | Balance Transfer Fees | Foreign Transaction Fees | Credit Needed |

|---|---|---|---|---|

| AMERICAN EXPRESS GOLD CARD | $250 | N/A | NONE | EXCELLENT/GOOD |

| CAPITAL ONE VENTURE REWARDS CREDIT CARD | $95 | 0% | NONE | EXCELLENT/GOOD |

| CAPITAL ONE VENTURE X REWARDS CREDIT CARD | $395 | N/A | NONE | EXCELLENT/GOOD |

| CHASE SAPPHIRE PREFERRED CARD | $95 | 5% | NONE | EXCELLENT/GOOD |

| CHASE SAPPHIRE RESERVE | $550 | N/A | NONE | EXCELLENT/GOOD |

| THE PLATINUM CARD FROM AMERICAN EXPRESS | $695 | N/A | NONE | EXCELLENT/GOOD |

SKYMILES CREDIT CARD WITH “NO ANNUAL FEES”

SkyMiles is the frequent-flier program of Delta Air Lines that offers points (or “miles”) to passengers traveling on most fare types, as well as to consumers who utilize Delta co-branded credit cards, which accumulate towards free awards such as airline tickets, business and first-class upgrades, and luxury products.

Created in 1981 as the “Delta Air Lines Frequent Flyer Program”, its name was changed to SkyMiles in 1995. Delta claims to have been the first major U.S. airline without mileage expiration, so travelers can redeem awards at their leisure, but others have since followed.

The airline also has a separate SkyBonus program that provides small to mid-sized business owners with a way to earn points for trips taken by employees, good towards free flights, upgrades, Medallion status, and other travel awards.

It has been ranked fairly highly according to some independent news outlets.

CREDIT CARDS THAT OFFER SKY MILES.

Two credit cards offer Sky miles and they are DELTA SKYMILES BLUE CARD & the DELTA SKYMILES GOLD CARD. Both the cards give 2X miles on restaurants worldwide and eligible Delta purchases.

The BLUE CARD has no annual fees and offers you a 10,000-mile bonus for spending $1,000 in the first six months. The GOLD CARD gives 2X miles on U.S. supermarkets and business purchases and has a $99 annual fee which is waived for the first year.

Faqs:

1) What are airline miles, and how do they work?

Airline miles are also known as frequent flyer miles travel points, and they are rewards that you earn through your spending activities. These miles can be accumulated and later redeemed for your travel and hotel stays, besides upgrades and other travel-related expenses.

2) Are there any limitations or block-out dates when it comes to redeeming your airline miles?

Several airline miles credit cards offer flexible redemption options allowing you to book your flights without blocking out dates or restrictions. But you need to check the terms and conditions of your specific credit card to ensure that there are no limitations when it comes to redeeming your airline miles. Some cards would have block-out dates during the peak travel season.

3) What is the best US bank credit card for international travel?

The U.S. Bank Altitude® Connect Visa Signature Card is one of the best credit cards to earn bonus points while traveling, having food as well a hotel staycation. It’s a wonderful choice as you can get great deals and bonus points.

4) Which credit card is the most used credit card in the USA?

Visa, Mastercard, as well as American Express, are one of the most used credit cards in the USA.

5) Do any airline credit cards have no annual fee?

United Gateway℠ Card is one of the best credit cards which doesn’t charge annual fees and is a great choice to go with!

Bottom line:

BANK OF AMERICA TRAVEL REWARDS, JETBLUE CARD, HILTON HONORS AMERICAN EXPRESS CARD are some of the best travel credit cards. These credit cards won’t charge you a single penny.

With the assistance of a CAPITAL ONE VENTURE REWARDS CREDIT CARD, and AMERICAN EXPRESS GOLD CARD you can some of the best rewards while traveling. You can go through the article to know more about credit cards and how does it work. We thank you for being part of our article.

If you find this information informative, then you should not think twice before sharing on your social media profile or sharing it with your loved ones.