The world of credit cards is exciting and challenging, especially if you have a credit score of 650. A credit score of 650 basically falls within the fair credit range, indicating that you might have encountered some challenges in managing your credit earlier. But this does not mean that you cannot access credit cards at all. You can always rely on credit cards for a 650 credit score.

A credit score of 650 is ultimately a common situation as unexpected turns of financial emergencies or just a lack of credit history can contribute towards this score. When you understand the options available for unsecured credit cards for a 650 credit score, you can rebuild your credit and establish a positive credit history.

Things you need to look for in credit cards for a 650 credit score

A great rewards program

A 650 credit score card must have a rewards program, and it can be a great tool if you want to maximize your spending. You need to look for a card that offers you rewards that align with your lifestyle and spending habits. Some of the most common rewards programs basically include cash back and points that you can redeem for merchandise or just gift cards. You must choose a card that offers you plenty of rewards that you can actually use to make the most of your credit card experience.

A low-interest rate

Even though it is essential to pay off the credit balance in full every month to avoid any interest charges, a low-interest rate can be beneficial in case you need to carry some balance from time to time. Credit cards with low-interest rates can save you a lot of money on interest charges if you need to finance any purchase or face any unexpected financial challenges.

No annual fees

An annual fee is a recurring cost that credit card issuers would charge you for the privilege of having the card. So when you choose a credit card for a 650 credit score, it is advisable for you to start with a card that does not have any annual fee. As you start building your credit history and improving your score, you might have access to cards with extra benefits and rewards, but creating with no annual fee allows you to focus on building an excellent credit history without incurring any unnecessary expenses.

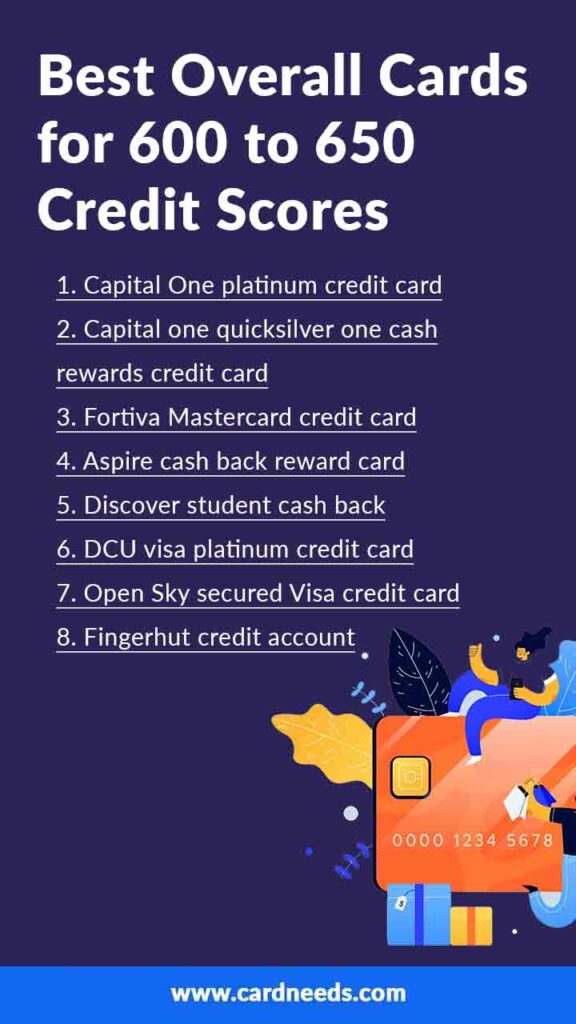

The best credit cards for a 650 credit score

Discover it cash back

It is one of the best cashback cards that offer you a rotating 5% cash back on different categories every quarter and 2% cash back at KS stations and restaurants, besides 1% cash back on all other purchases that you make. This card is a prominent option as it offers you generous rewards programs and no annual fee. Furthermore, it also provides you free access to your 650 Fico score, allowing you to track your progress as you start building your credit.

Capital One Quicksilver cash rewards credit card

If you’re looking for high-limit credit cards for a 650 credit score, then you need to look no further, as this one is your best bet. It offers you a simple 1% cash back on all the purchases you make, making it a simple and rewarding option if you have a credit score that is fair. The card has no annual fee and provides you quick access to capital one credit-wise, which is a tool to monitor your credit score, and you can also get customized credit tips.

Chase freedom unlimited

The chase freedom unlimited card offers you a rotating 5% cash back category every quarter and 3% cash back on dining and drugstore purchases. You can also get 1% cash back on all other purchases. The card is entirely well known for its reward program, and it does not have any annual fee. It also provides you access to the credit management tools.

Wells Fargo active cash card

The Wells Fargo active cash card offers you 2% cash back on purchases for the first 12 months after you open the account, and you can get 2500 in spending. After the initial 12 months, it continues to provide you with 1.5% unlimited cash rewards. It is one of the best credit cards for a 650 credit score, and it does not have any annual fee and offers you access to Wells Fargo’s credit score monitoring tools.

Capital One platinum credit card

Capital One platinum credit card offers the best 650 credit score car loan, and it is a unique design for you if you have a credit unit that gives you a path to build your credit responsibly. While it does not come with a rewards program, it can work as a valuable tool to demonstrate responsible credit management and potentially upgrade to a rewards card in the future. The card does not have an annual fee, and it also provides you access to credit monitoring.

Indigo platinum mastercard

Indigo Platinum MasterCard is an excellent option for you if you have fair credit. While it does not offer any rewards, it can provide you access to credit if you are looking forward to rebuilding your current history. The card has some annual fees, so it is essential to weigh the cost against all the benefits of establishing or improving your credit score.

So when it comes to choosing the best credit cards for a 650 credit score, you need to consider all the factors given above. You can select a credit card that aligns with your financial objectives using responsible credit management practices and taking advantage of all the rewards and benefits. You can set yourself on a path to improve credit and better economic opportunities with this. If you find this helpful, please share this on your social media and share some knowledge with your loved ones.

FAQS

Can you get approved for a credit card with a 650 credit score?

Yes, you can get approved for a credit card with a 650 credit score. While a credit score of 650 is considered fair, it will still fall within the range where several credit card issuers offer credit cards to applicants.

Will having a credit card help you improve your credit score?

Yes, having a credit card can help you improve your credit score provided you use it responsibly. Your credit score is influenced by different factors like payment history, credit utilization, and credit mix. By making timely payments and keeping your credit utilization low, you can positively impact your credit score.