Student credit cards give students with no credit the chance to save money while building the kind of credit history that will be essential after graduation. The best student credit cards have $0 annual fees, give at least 1% back in rewards on all purchases, and report to all 3 major credit bureaus each month.

The biggest requirements for student credit card approval are being at least 18 years old and having enough independent income to afford monthly bill payments, which are usually around $10 for student cards.

If you open a student credit card account, the key to building credit is to pay your bill on time every month and avoid maxing out your credit line. As long as you do those things, you will begin building the credit needed to rent an apartment, buy a car, take out a good loan, and save on insurance premiums once you graduate.

It may even help you get a job if you plan on working in a field that requires a security clearance or handling money.

The best credit card for students with no credit is the Capital One SavorOne Student Cash Rewards Credit Card because it has a $0 annual fee and some of the best perks available to people with limited or no credit. For starters, new applicants who make $100 in purchases within 3 months of opening an account get an initial bonus of $50.

The Bank of America Travel Rewards credit card for Students doesn’t charge an annual fee, sports easy-to-earn rewards, and offers a solid welcome bonus, but we also recommend it for study abroad use as it has no foreign transaction fees.

As a student, you have access to a range of credit cards specifically designed for students. These cards are easier to get — issuers know students are unlikely to have much credit history, and they approve applicants accordingly — but they’re also often much better quality cards that are available to first-time cardholders who are not students.

Indeed, many student credit cards very closely resemble their non-student counterparts, offering low fees and purchase rewards that would otherwise require good to excellent credit to enjoy.

Since your first card will likely be your oldest credit account, having a student card that you can hang onto indefinitely can be a great decision.

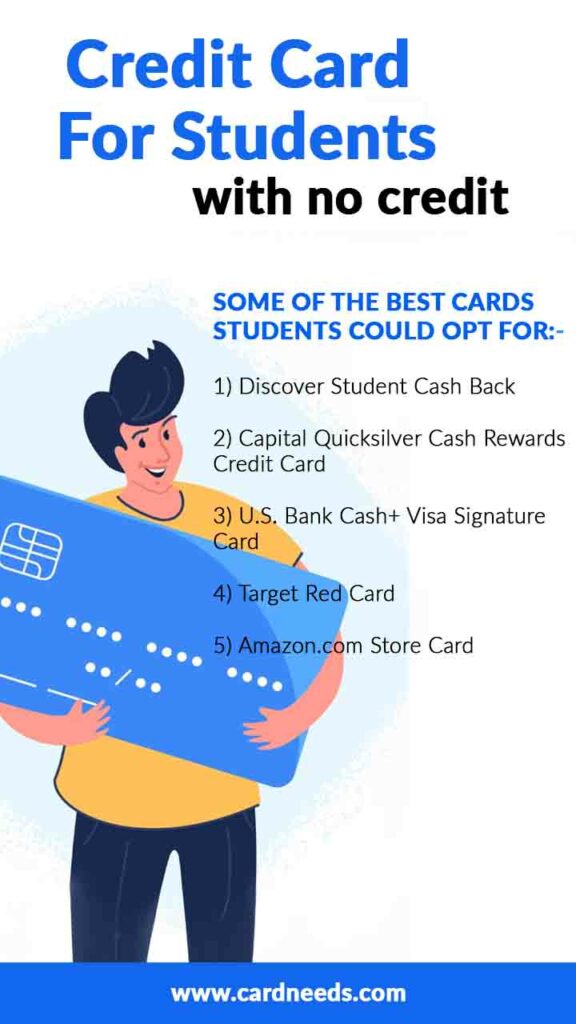

BELOW MENTIONED ARE SOME OF THE BEST CARDS STUDENTS COULD OPT FOR:-

1) Discover student cash back

2) Capital Quicksilver cash rewards credit card

3) U.s. bank cash+ visa signature card

4) Target red card

5) Amazon.com store card

For applying for certain cards there is an age limit some of them are given below:

1. American Express-13

2. Bank of America-None

3. Barclays-13

4. Capital one-None

5. Chase-None

6. Citi-None

7. Discover-15

8. U.S. Bank-16

9. Wells Fargo-None

Alternate ways to get a credit card while unemployed:

1) Become an authorized user on someone else’s card

2) Get a co-signer

3) Get a secured credit card

Can You Have a Credit Score If You Have No Credit?

It’s no secret that personal finance education in AMERICA is lacking, leaving many Americans with incomplete information that can be more than just confusing — it can be downright expensive.

A bad credit history can lead to high fees and poor interest rates that can add up fast.

That’s because credit scores are based entirely on the information in your credit reports. But, you don’t get a credit report until you have a credit history.

And you don’t build a credit history without opening a credit-based account like a credit card or loan.

What is an unsecured credit card?

An unsecured credit card is simply a card that doesn’t require a deposit, or collateral, to open an account. This is the most common type of credit card.

People with fair credit are somewhat risky for creditors. They have a greater chance of defaulting than someone with a higher score, which is why applicants with fair credit are often denied new cards.

Credit cards for people with fair credit are designed to offer a second chance while also protecting the lender against the possibility of default.

Who can get an unsecured credit card for fair credit?

Unsecured credit cards for fair credit are designed for people who have trouble getting approved for regular cards.

These credit cards have lower approval requirements, so you may be approved for one even with a fair credit score.

They can offer a good opportunity for rebuilding or establishing your credit, but they often have drawbacks like high-interest rates and fees.

Unsecured credit cards for fair credit are useful for people who:

1) Have a fair FICO score (669 and below)

2) Want to establish a credit history

What is the difference between unsecured and secured credit cards?

A secured credit card, unlike the more common unsecured cards, requires cardholders to put down a deposit – typically 50% to 100% of the credit limit – to insure the account in case the customer fails to make payments.

If you miss a monthly payment on a secured card, the creditor may use money from the deposit to pay the bill.

Most secured credit cards have very low starting credit limits. These types of accounts are for people with bad or no credit as a way to build their scores and eventually, move to unsecured cards.

From a business perspective, it limits the amount of risk that a credit card company assumes.

There are 2 sides to every coin this goes the same with the whole concept of credit cards so the main question that arises is what benefits and drawbacks we have to face for opting for fair credit unsecured credit cards.

Benefits of unsecured cards for people with fair credit:

1) No initial cash deposit

2) Higher credit limits

Drawbacks of unsecured cards for people with fair credit:

1) High-interest rates

2) Potentially high annual fees

3) Possible monthly maintenance fees

Credit Cards for students can help build a successful financial future when handled responsibly.

Most credit cards for fair credit charge an annual fee to maintain the account, either in one large sum or divided into monthly installments. Many charge a variety of additional fees as well, including monthly maintenance charges, account verification fees, and credit limit increase fees.

All of these fees are charged directly to your balance, where they will accrue interest just like a purchase.

Even if you never use the card for purchases, just owning it and incurring fees will cost you money. Plus, credit limits on unsecured cards for fair credit are typically much lower than traditional cards.

All of those fees can result in a high utilization ratio, which can have a negative effect on your credit score.

Hence these are some of the credit cards Bank of America offers students.

1) Bank of America customized cash rewards for students

2) Bank of America unlimited cash rewards for students

3) BankAmericard for students

4) Bank of America travel rewards for students.

Rules to follow while selecting a credit card as a student:

1. Managing your credit card

2. Paying down your debt

3. Improving your credit card

BOTTOM LINE:-

Considering all risks before applying for a new credit card while unemployed remains imperative, as it would be when using any line of credit under any circumstances.

Ensure balances won’t skyrocket and will be paid off monthly to avoid paying interest charges.

Unemployment can be dreadful. But options exist for building and maintaining credit while finding another job.