Buying the groceries and making the payments for the gas through credit cards not only shows that you manage your credit responsibly but also builds a strong credit history.

Many factors influence your credit score!!

The main or let’s say the one piece is your payment history. Payment history works as solid proof to show future lenders that you manage and maintain your credit properly.

While making the payment for the gas you have 2 options one is to use the card issued by the gas stations and another is to use more general rewards cards that offer bonus rewards for gas purchases.

If you are planning to save pennies while paying for groceries and gas the easiest and the smartest way is to opt for the best credit card which typically offers you a percentage% of your total purchases as cash back. These rewards usually appear on your money statements.

Is it good to buy everything with a credit card?

Nerdwallet recommends paying with a credit card whenever possible. Credit cards are easier and safer to carry than cash and offer stronger fraud protections than debit.

You can earn significant rewards without changing your spending habits. It becomes very easy to track your spending.

Visa & MasterCard which is better in the U.S.?

Both of them offer a similar set of fundamental features on entry-level credit cards therefore there is very little distinction between the two.

On WORLD or WORLD ELITE level credit cards, MasterCard does contain stunning extra luxury incentives that can be alluring to heavy consumers.

Which gas card is easiest to get?

On WORLD or WORLD ELITE level credit cards, MasterCard does contain stunning extra luxury incentives that can be alluring to heavy consumers.

Which gas card is easiest to get?

Consumers with credit scores between 670 and 850 have a chance of receiving approval for these cards.

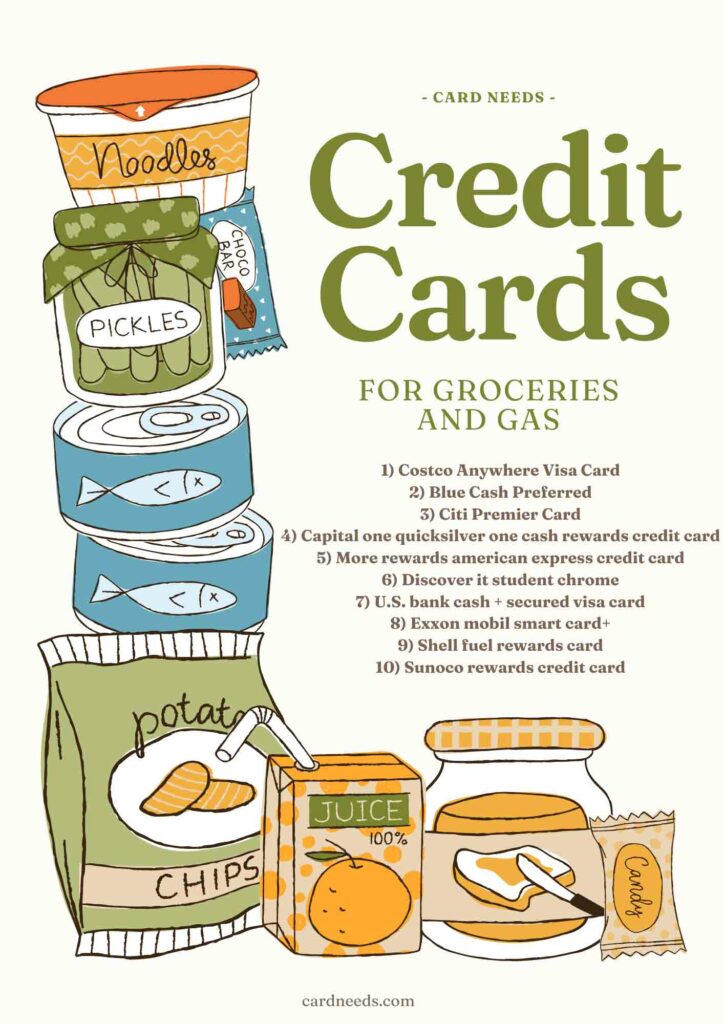

1) Costco Anywhere Visa Card

2) Blue Cash Preferred

3) Citi Premier Card

4) Capital one quicksilver one cash rewards credit card

5) More rewards american express credit card

6) Discover it student chrome

7) U.S. bank cash + secured visa card

8) Exxon mobil smart card+

9) Shell fuel rewards card

10) Sunoco rewards credit card

Unless you can take advantage of other higher rewards categories, a gas credit card may not make sense for your wallet if you work from home or rely on public transit regularly. But a gas card may suit your budget if you spend a lot of time behind the wheel.

Most gas stations offer loyalty programs that offer points for purchases that can then be used for merchandise or discounted gas.

Some programs let you connect an existing debit or credit card with an account to earn rewards. However, gas credit cards are typically more rewarding and flexible.

Best cash-back credit cards for groceries and gas:

You can get bonus cash back for both gas and grocery purchases with the Bank of America Customized Cash Rewards credit card.

All you have to do is choose gas stations as your bonus category while earning elevated rewards on grocery shopping.

FAQ’S

How to choose the best cashback credit card?

You can get bonus cash back for both gas and grocery purchases with the Bank of America Customized Cash Rewards credit card. All you have to do is choose gas stations as your bonus category while earning elevated rewards on grocery shopping.

Which American Express card offers the highest cash-back rate?

Frequent grocery shoppers will be happy to learn the Blue Cash Preferred Card from American Express offers the highest cash-back rate at U.S. supermarkets at 6%.

The average American can earn $310 in cash back each year when they do their shopping at qualifying supermarkets.

What are the best credit cards for groceries?

The best credit cards for groceries are rewards credit cards that offer 1.5% to 6% back on purchases at grocery stores and supermarkets while charging annual fees as low as $0. These cards could save the average household hundreds of dollars on their annual grocery bills.

Do gas station credit cards offer instant approval?

Just about all gas station credit cards can offer instant approval (or denial), especially when you apply online. But issuers never guarantee an instant decision. You’re likely to receive one if you apply for one of the easiest gas cards to get.

What are the top gas credit cards for instant approval?

1)Best gas credit cards for instant approval

2)Walmart store card

3)BP credit card

4)Shell credit card

5)Blue cash preferred card from American Express

On the other end of the spectrum, if you have above the 750 credit score needed for the Costco Anywhere Visa, you may want to apply for that instead. If you apply in-store and get approved, they’ll give you a code you can use to make Costco purchases right away.

The Costco Anywhere Visa offers 4% cash back on the first $7,000 per year spent on gas and 1% after. It gives 3% back on restaurant and travel purchases, 2% at Costco, and 1% everywhere else.

There are plenty of other good gas cards that offer instant approval. But the Costco card is one of the few you can use right away.

What’s the easiest unsecured credit card to get approved for?

One of the easiest unsecured cards to get approved for is the Credit One Bank Platinum Visa for Rebuilding Credit because you can get approved for it even with bad credit.

This card offers a $300 starting spending limit, and you can use it wherever Visa is accepted.

What are the best gas credit cards for bad credit?

One of the best gas credit cards for bad credit is the Bank of America® Customized Cash Rewards Secured Credit Card, which gives cardholders 3% cash back in the category of their choice, including gas.

Bank of America Custom Cash Secured Card has a $0 annual fee, but you need to place a security deposit of at least $200.

What is the best credit card you can use instantly?

The best credit card you can use instantly is the Blue Cash Preferred Card from American Express. You can access the card number immediately after being approved for an account online, then begin to make purchases until you receive the physical card in the mail.

Blue Cash Preferred offers up to bonus cash-back rewards in certain spending categories and a $250 statement credit for spending $3,000 in the first 6 months. It also requires a minimum of good credit for approval.

Bottom line:-

In conclusion, credit cards have become an integral part of our modern financial landscape, offering convenience, flexibility, and numerous benefits. However, it is crucial to approach credit card usage responsibly to avoid falling into debt or facing financial difficulties.

By understanding the terms and conditions, monitoring spending habits, and making timely payments, individuals can make the most of their credit cards while maintaining a healthy financial lifestyle.

Ultimately, the key to credit card success lies in responsible usage, disciplined spending habits, and diligent monitoring of one’s financial situation. By doing so, individuals can harness the power of credit cards to their advantage, enhancing their purchasing power and financial stability while avoiding common pitfalls.

Remember, it’s not the credit card itself that determines one’s financial health, but rather how it is managed and utilized in one’s overall financial strategy.